B) AllowancesĪn allowance is the additional amount paid to an employee above the basic pay as a part of the employee benefits.

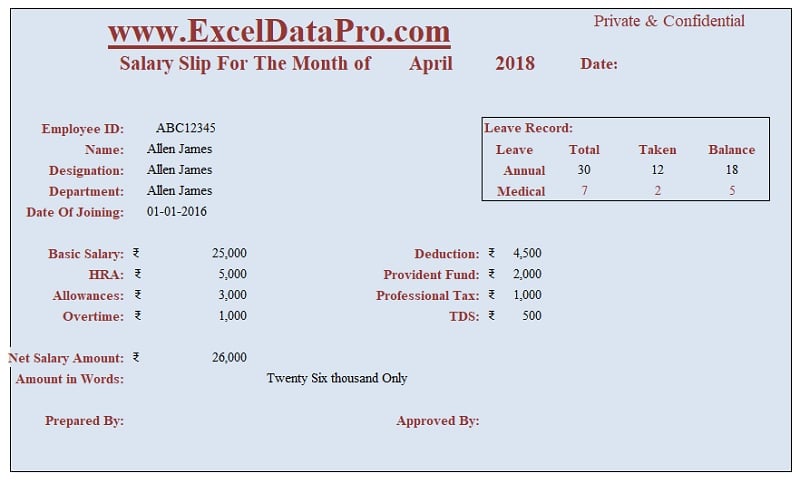

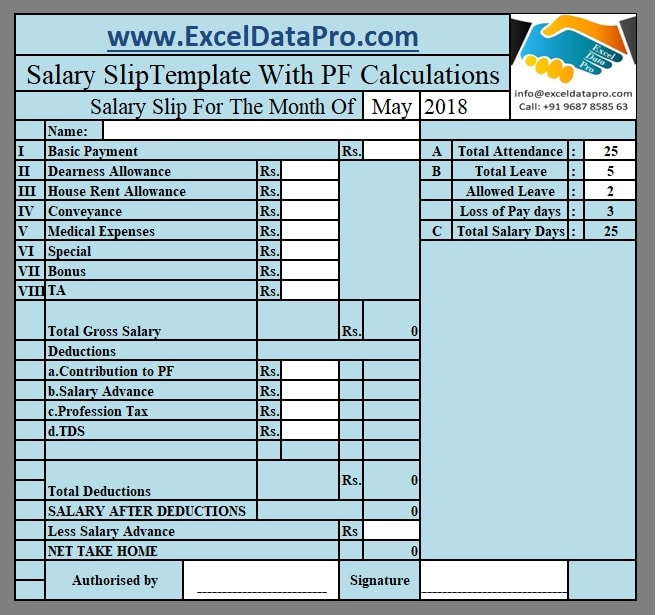

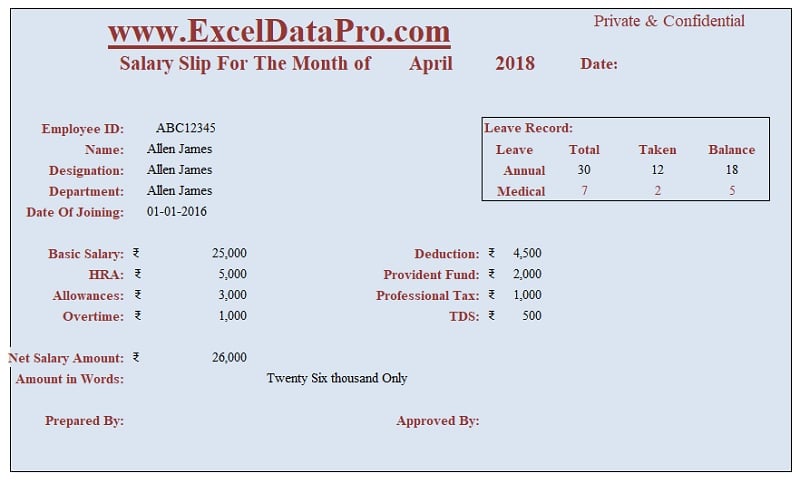

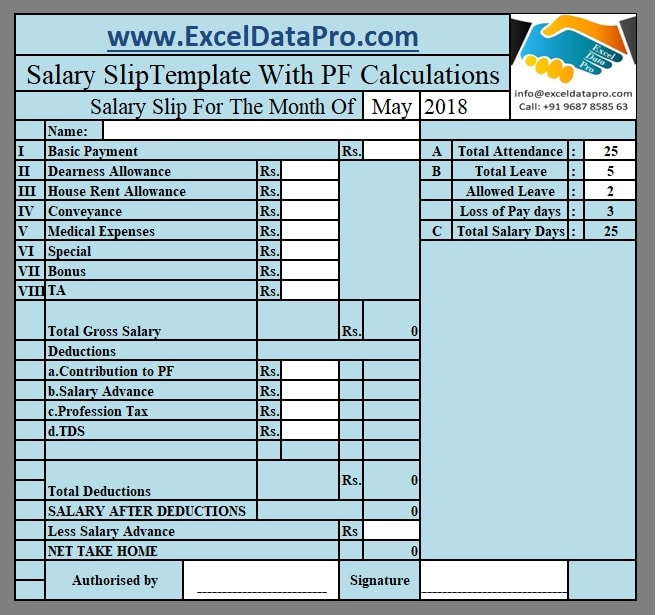

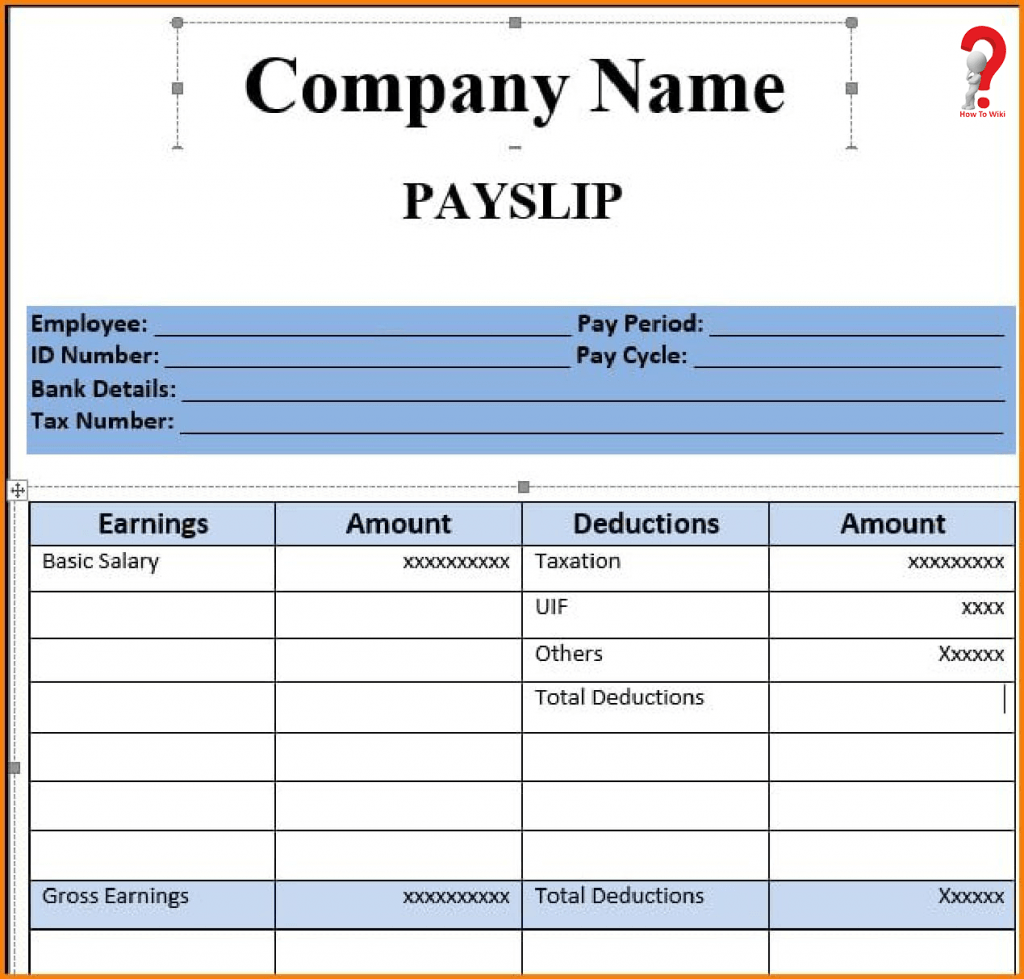

Net salary or take-home salaryĪs mentioned in the sample salary slip, net salary is the total salary an employee gets after tax, provident fund, and all the mandatory deductions are made from the total gross salary. Components such as bonuses, overtime pay, holiday pay, HRA, PF, professional tax, etc. It is the term used to describe the salary of an employee before tax or other deductions. It is usually fixed at 30-50% of the take-home salary and depends on the employee’s designation and the industry in they work. The basic salary is the fixed part of an employee’s income which excludes the overtime pay, allowances, bonuses, or any other gratuity payments. Moving on we’ll now put the light on the components of a salary slip.Īn employee salary slip generally consists the following components A) Income 1. You can easily generate an employee salary slip by making use of the salary slip sample given above.

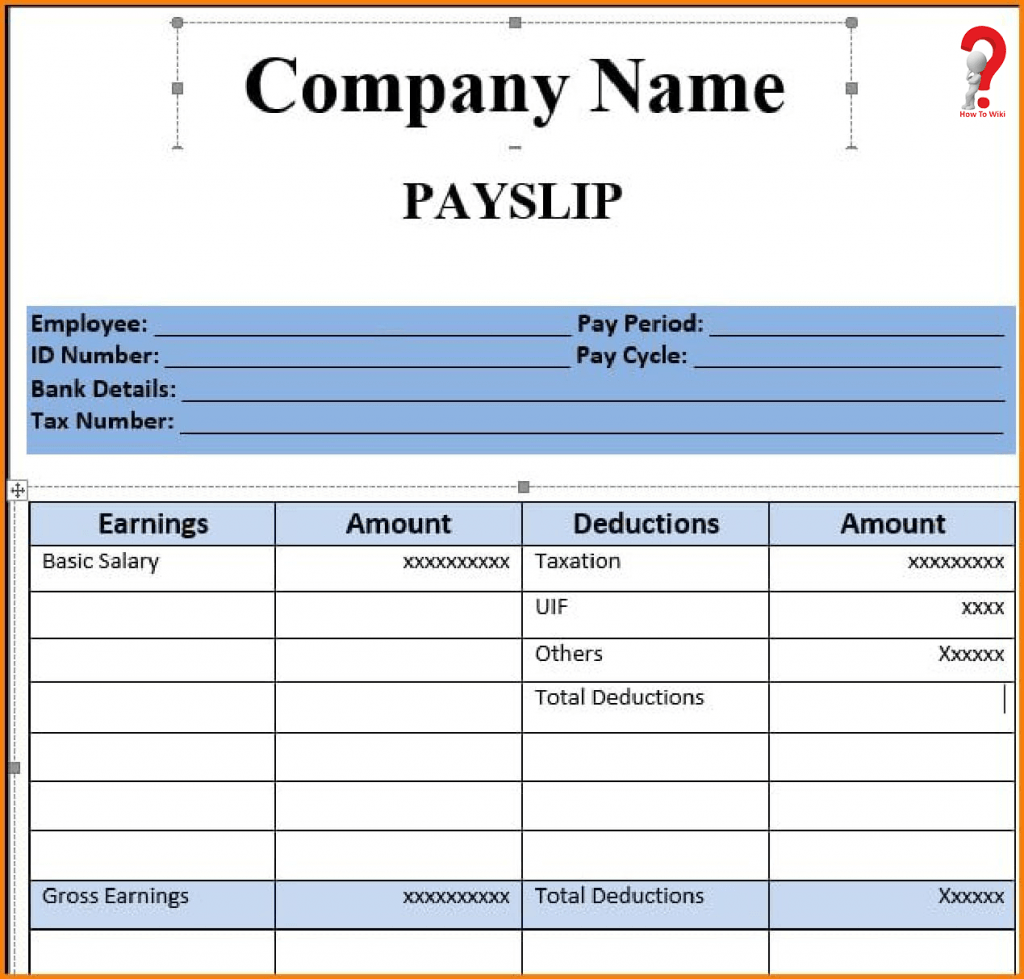

Signatures of both employee and employerīelow is a sample salary slip format in India: Company Name. Provident Fund account number of employee.

Signatures of both employee and employerīelow is a sample salary slip format in India: Company Name. Provident Fund account number of employee.  Employee’s bank name and account number. The most common salary slip format in India includes the following information: The Salary Slip Format in IndiaĮmployee salary slip format in India is generally the same in every organization. Also, the amount of refund to be claimed by an employee for the year. The payslip holds importance to every employee because it assists in preparing for the Income Tax Returns (ITR) and determining the amount of tax that is to be paid. A salary slip is generated as soon as your paycheck comes in. The slip stipulates everything from gross salary, and deductions to the net amount that’s to be taken home. Also the components of salary slips, and their importance.Ī salary slip or payslip is a document an employee receives from their organization every month. Moving forward, through this blog we’ll put a spotlight on aspects such as – employee salary slips and employee salary slip format in India. Salary slips are an important aspect but still, a majority of the population doesn’t understand the concept and how to attain one, and what salary slip format in India is followed. To be on the safer side, you can always ask your organization to issue a monthly salary slip to save you any future hassles. That’s not an issue, you can always ask your previous organization to share the salary slip, or either ask your bank for your bank statement. These salary slips are proof for the HR professionals to know about your employment with your previous organization or sometimes to finalize a new CTC.įrequently people don’t have their salary slips at hand. “Please share your salary slip” is a phrase you hear often when joining a new company.

Employee’s bank name and account number. The most common salary slip format in India includes the following information: The Salary Slip Format in IndiaĮmployee salary slip format in India is generally the same in every organization. Also, the amount of refund to be claimed by an employee for the year. The payslip holds importance to every employee because it assists in preparing for the Income Tax Returns (ITR) and determining the amount of tax that is to be paid. A salary slip is generated as soon as your paycheck comes in. The slip stipulates everything from gross salary, and deductions to the net amount that’s to be taken home. Also the components of salary slips, and their importance.Ī salary slip or payslip is a document an employee receives from their organization every month. Moving forward, through this blog we’ll put a spotlight on aspects such as – employee salary slips and employee salary slip format in India. Salary slips are an important aspect but still, a majority of the population doesn’t understand the concept and how to attain one, and what salary slip format in India is followed. To be on the safer side, you can always ask your organization to issue a monthly salary slip to save you any future hassles. That’s not an issue, you can always ask your previous organization to share the salary slip, or either ask your bank for your bank statement. These salary slips are proof for the HR professionals to know about your employment with your previous organization or sometimes to finalize a new CTC.įrequently people don’t have their salary slips at hand. “Please share your salary slip” is a phrase you hear often when joining a new company.

0 kommentar(er)

0 kommentar(er)